SERVICES

Investment & Insurance

Insurance and investments are the two vital part of any financial planning. It is important for you to approach the right financial company at the right time to get the right insurance and investment option that will help you attain your financial goals. This is where we step in.

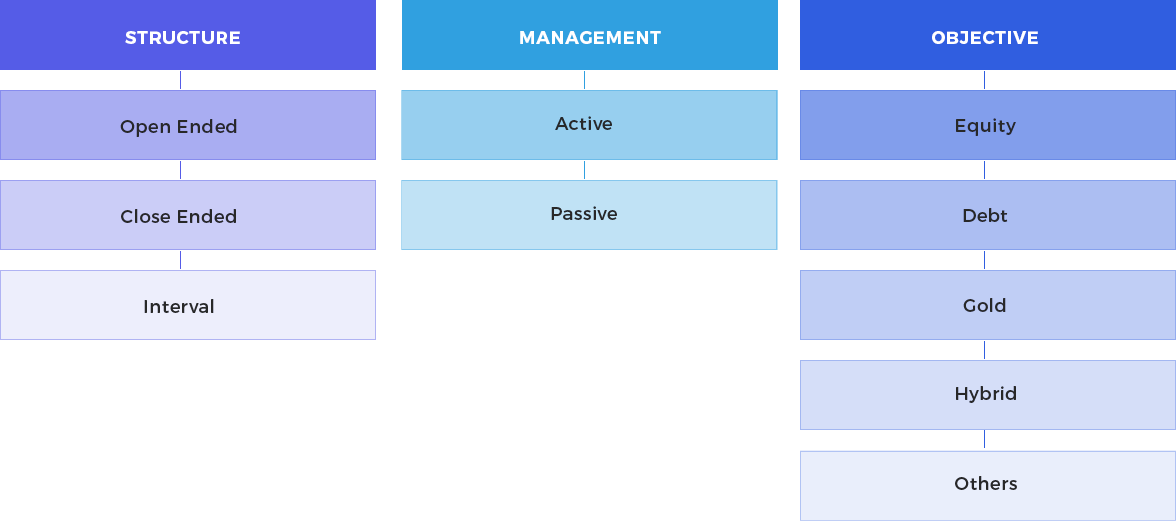

Mutual Fund Types

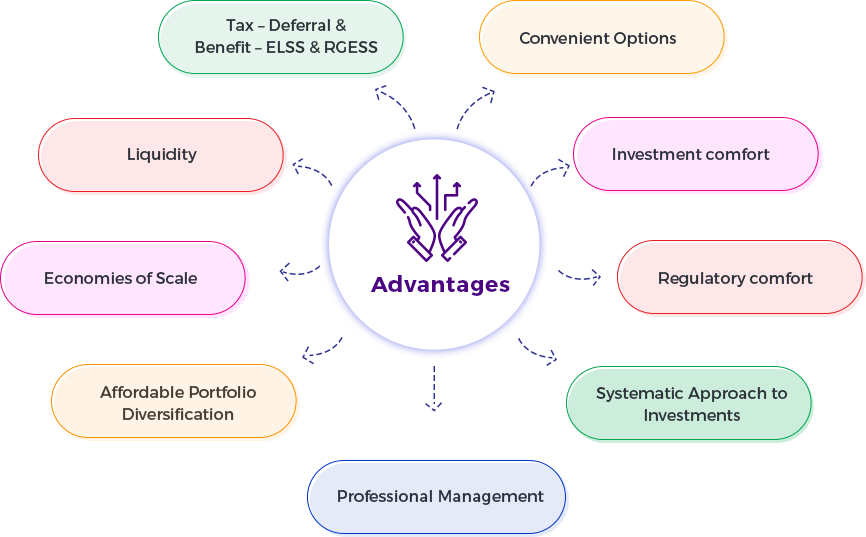

Mutual Fund Advantages